Director Confidence Index – February 2023

February 28, 2023

Kira Ciccarelli

Topics:

It was the best of times, it was the not-quite but maybe soon the worst of times. Again.

That’s the story from Corporate Board Member’s February reading of economic sentiment among public company directors. Resolving supply chain issues—including bottlenecks and shortages—are fueling many directors’ improving ratings of current and future business conditions. Dampened inflation and forecasts of lower rates are why over one-third of directors expect conditions to improve further, with many pointing to a higher probability of a “soft landing.”

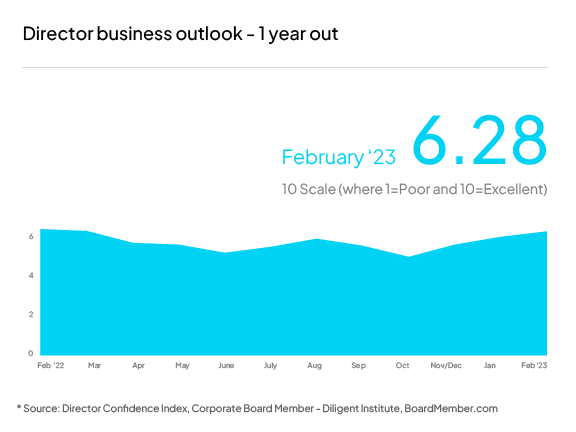

It’s also likely why directors’ forecast of business conditions 12 months from now ticked up another 5 percent in February, adding to two months of consecutive gains. Their forecast now stands at a 6.3 out of 10, according to the February Director Confidence Index, our monthly sentiment poll conducted in partnership with Diligent Institute, fielded between February 21-26. Their rating of current conditions also ticked up 5 percent in February, to 6.2 out of 10—the highest rating since April of 2022, before the Fed began raising rates above 1 percent.

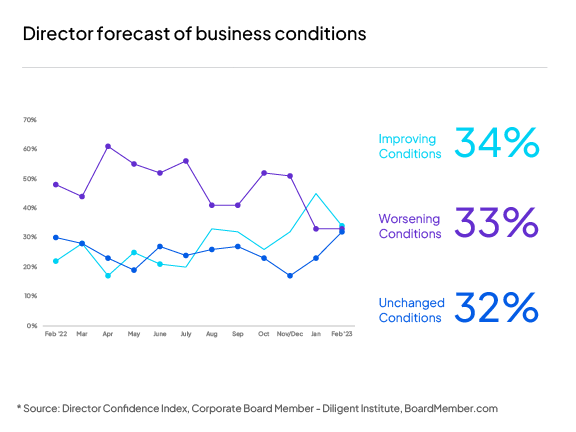

And yet, despite these upticks in both ratings, directors remain split about where the economy is headed— with almost equal proportions predicting improving, worsening and unchanged business conditions. Many are encouraged by stable demand and employment coupled with lowered inflation, while others believe ongoing high interest rates and experienced inflation diminish consumer buying power and will lead to weaker demand. That, together with geopolitical conflict, makes for worse business conditions 12 months down the line, according to many directors. The one thing both sides agree on, however, is that there is a great deal of uncertainty.

The proportion of directors forecasting improving conditions dropped to 34 percent this month from 45 percent the month prior—due in part to a climb in their rating of current conditions.

“While inflation has somewhat declined in the last 4 months, the Fed is likely to continue with another 2-3 smaller rate increases to further lower inflation in the next 2 quarters. Employment will remain resilient to bring us to a healthier state by early 2024.” -S. Ari Papoulias, Director, United Guardian, Inc.

Gary LeDonne, outside director at MVB Financial, agrees with Papoulias’ take. “There is an expectation of continued interest rate increases through Q2 / Q3 2023,” he says. “Expect a mild recession in mid-2023. Hopefully, the economy turns positive in early to mid-2024.”

Clayton Woodrum, audit committee chair at Ring Energy, is positive about both the current and future economy, rating them a 9 out of 10. “Demand is still increasing. There is very low unemployment. Companies are reducing staff to the proper level, particularly Tech.” He goes on to mention his take on geopolitics, “China coming back online. Russia is ending war one way or another. Either winning or losing…”

Still, a full third of directors expect the economy to be worse off one year from now. Whether it be due to domestic policy or international security concerns, directors are split. “It appears that the Fed may orchestrate a soft landing, but broader geopolitical issues make me more cautious about the future,” says Susan Skerritt, director and audit committee chair of Tanger Outlet Stores. She expects economic conditions will worsen.

Emily Peterson Alva, board member at Anmeal and Alkermes, is also cautious about the future and the continued impact of inflation and high interest rates. “Inflation is a profoundly bigger issue than a transitory one,” she says, adding: “Rising interest rates impact profitability for corporations across sectors and will have a compounding effect. It also may dampen investment either organic into capex/ R&D, etc., or inorganic/external investments/M&A and other strategic initiatives outside the status quo for a given company.”

The year ahead

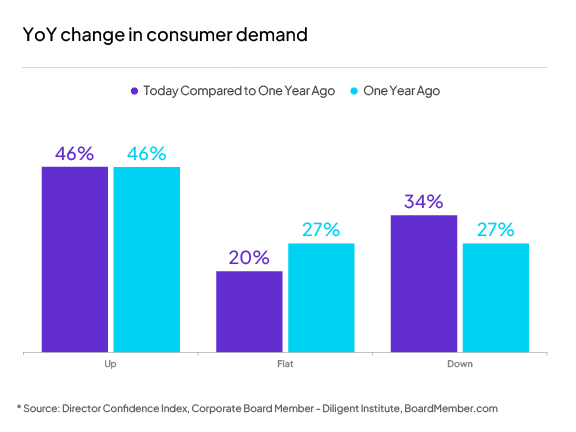

The proportion of directors who say consumer demand is up compared to a year ago climbed in February to 46 percent, clawing back all of last month’s losses. The proportion forecasting a boost in demand one year down the line grew again in February, up from 43 percent to 46 percent, an indication that many directors believe demand is steady and will hold steady in the year to come.

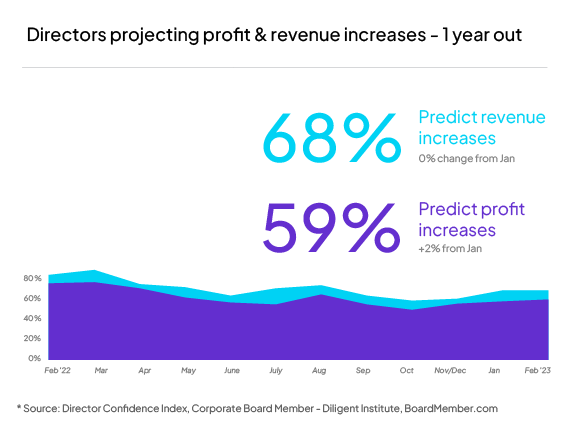

The proportion of directors who project increasing profits over the 12 months climbed 3 percent in February to 59 percent—the highest proportion since 3Q22 and now a higher proportion than the 56 percent of CEOs who think the same. Meanwhile, the proportion of directors forecasting increases in revenues remained unchanged at 68 percent.

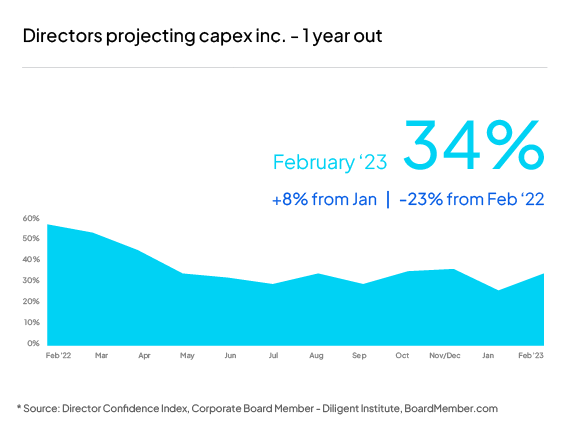

Some 34 percent of directors project increases in capital expenditures over the course of the next 12 months, up from 26 percent in January, but still far below the majority of CEOs, who tell sister publication Chief Executive that they plan to increase their capital spending over the same period.

Information flow to the board

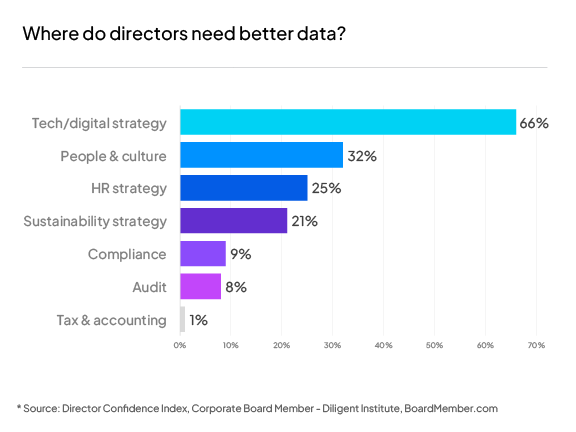

This month, we also asked directors about which area of the business they want more insight into. Overwhelmingly, digital/tech strategy was the most popular answer, at about two-thirds of our respondents. People and culture came in second place at 32%, followed by HR strategy at 25%.

About the author

Lead Research Specialist

Kira Ciccarelli is the Lead Research Specialist of the Diligent Institute, the modern governance think tank and global research arm of Diligent Corporation. In her role, Kira researches and produces high-level modern governance reports, blog articles and podcasts designed to inform director decision-making and highlight best practices.

Before joining Diligent, Kira worked in a variety of data-driven research roles, including analyzing global aid funds to the UN Sustainable Development Goals (SDGs) and compiling a meta-analysis of political experimental findings for the Analyst Institute. She holds a BA in Public Policy from the College of William & Mary.

Related content

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – March 2023

This month, a growing proportion of directors see the business landscape improving in the…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Inform

What Directors Think 2023

Diligent Institute and Corporate Board Member surveyed 300 U.S. public company directors…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – January 2023

U.S. board members continue their streak of optimism in January fueled by recovering…