Director Confidence Index – October 2023

October 29, 2023

Kira Ciccarelli

Topics:

Director confidence falls to lowest level of 2023 in latest poll

The punches keep coming, it seems—and they are being dealt across all levels of leadership, from CEO to CFO, to CHRO, to CIO, to board members, according to Chief Executive Group’s Confidence Index series, which tracks C-Suite sentiment, priorities and forecasts for the year ahead.

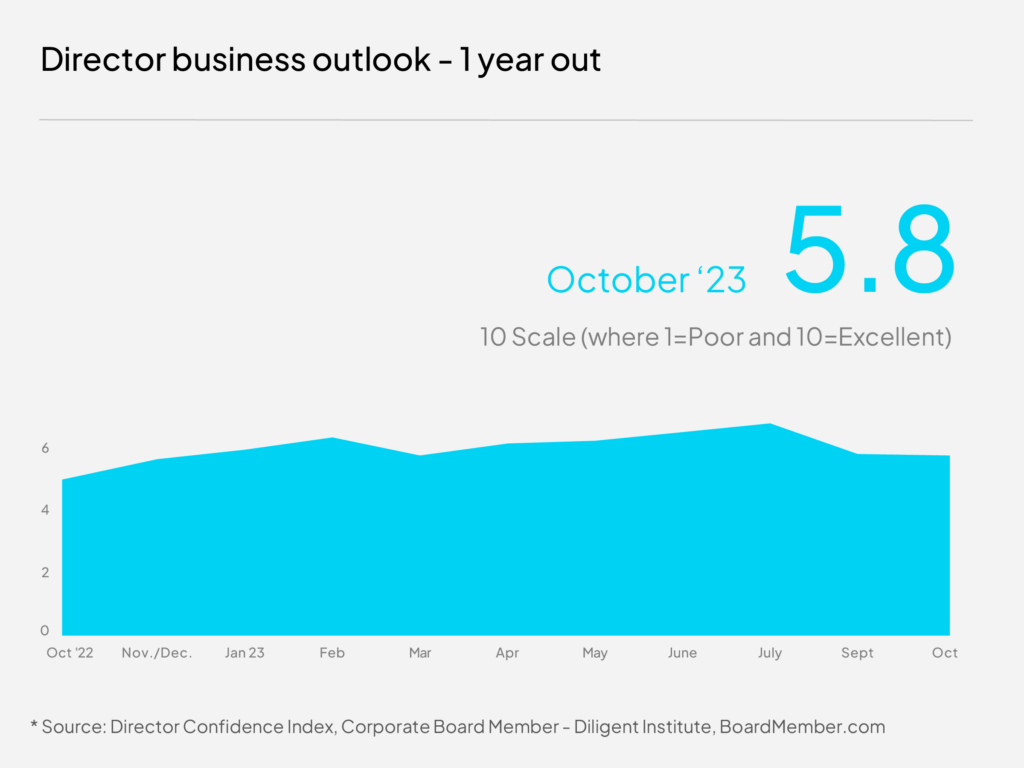

Last time we checked in with board members, in July as part of the Director Confidence Index, there was a surge in optimism that the risk of a recession had faded, thanks in part to the anticipation that the Fed was getting ready to pause—and likely end—its quantitative tightening. This sentiment then bolstered the Index by 5 percent, to its highest level in over two years: 6.8 out of 10, on a scale where 10 is Excellent and 1 is Poor. But that didn’t last long.

In early September, when we took the pulse of directors again, we found their July optimism eclipsed by renewed concerns over the likelihood of a recession in 2024, as directors weighed the impact of further rate increases—on the economy in general, as well as on business and consumer spending. Those concerns sent our forward-looking indicator sharply lower, to 5.8—a drop of 15 percent since the July high.

One month later, our October reading of director confidence, measured over the first two weeks of the month, isn’t showing any improvement. While the Index hasn’t declined further—it remains at 5.8—new issues have surfaced, including the Israel-Hamas war, souring relationships with China, as well as the impact of the upcoming presidential election in the U.S. and the long-term effects of lingering inflation on the overall economy.

Directors polled said despite healthy economic indicators and continuously strong demand, for most sectors, the number of uncertainties in the current environment is making it nearly impossible to tell what’s around the corner—and whether a recession is imminent.

“My sense is the next year will determine whether we have a soft landing or not,” said Peter L. Bain, an independent director currently serving on the board of Virtus Investment Partners. “During this period, I anticipate anxiety that will likely impact markets and economic activity marginally negatively.”

Several directors noted their growing concern with the longer-term effects of the Fed’s decisions, and many believe the repercussions of this year’s rate increases have yet to transpire across all sectors and through the economy, which, they say, is likely to cause longer delays before we see a recovery.

“I think [the outlook] varies by sector,” said a director who serves on the board of a technology company, “but we haven’t fully acknowledged that lack of spending in certain sectors has reduced growth rates.”

Agreed a director at a publicly traded financial services company: “The effects of inflation and higher interest rates will start to hit the economy in 2024, slowing it down considerably.” For that reason, he expects conditions to go from 7 out of 10 today to 4/10 by this time next year.

Dorlisa Flur, a strategic advisor and a corporate director serving on multiple public company boards, said that while the Federal Reserve seems to be balancing interest rates and unemployment goals to avoid a recession, “consumers are still faced with higher prices (even if now stabilized), and many have less cash flow due to cessation of Covid payments, student debt restarting, etc.”

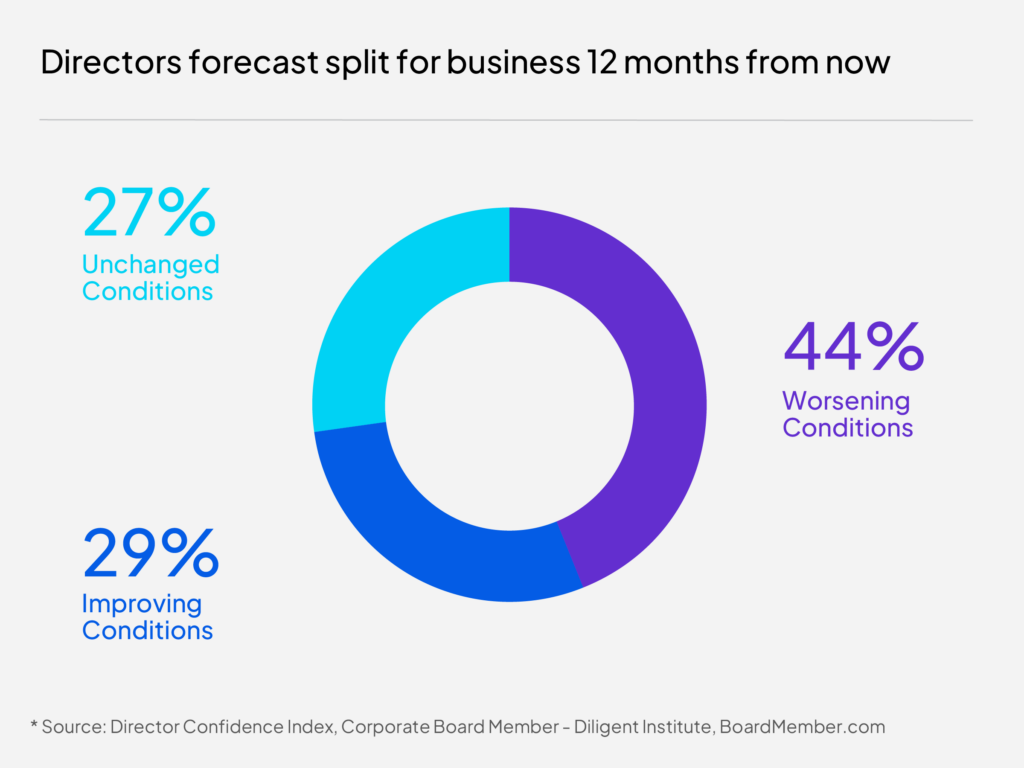

Only 29 percent of directors polled in October said they expect conditions to improve in the next 12 months—down from 45 percent at the beginning of the year. Instead, 44 percent expect them to deteriorate further, and 27 percent expect more of the same by this time next year.

“Things will get worse before they get better,” said the lead director of a consumer-packaged goods company, echoing the near majority forecasting conditions to worsen. “Inflationary conditions will catch up with business.”

C-suite comparison

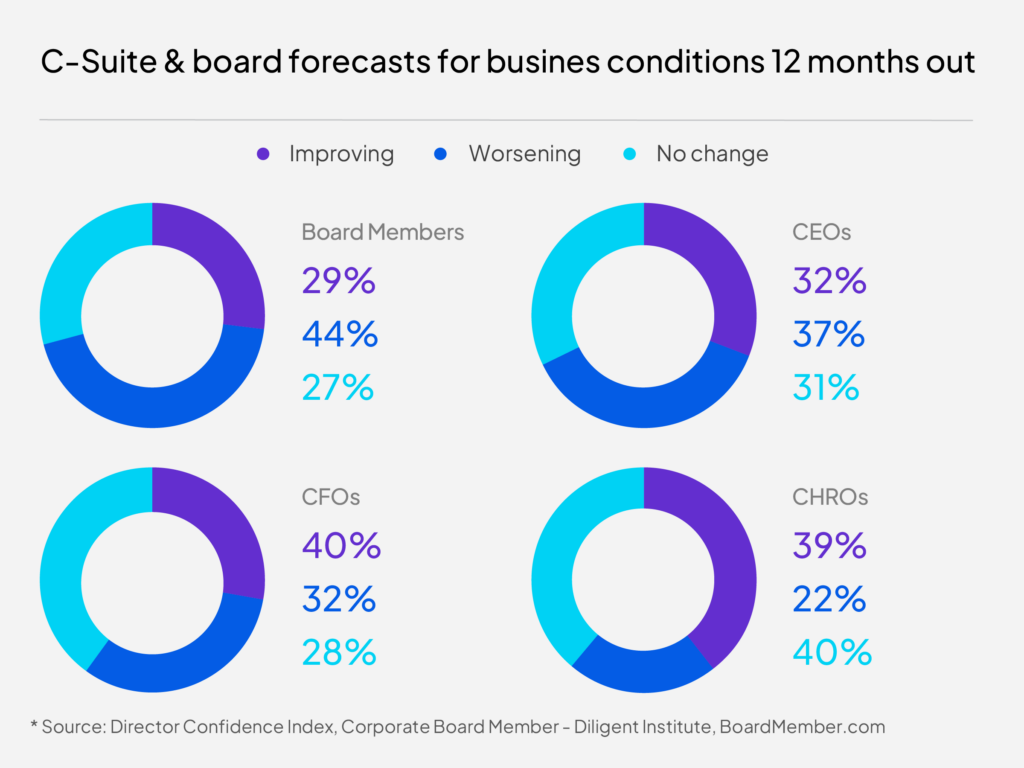

This sentiment is not isolated to board members. Members of the senior executive team also reported gloomy forecasts for the months ahead.

Only 32 percent of CEOs polled the first week of October by sister publication Chief Executive, as part of our CEO Confidence Index, said they believe conditions will have improved by this time next year. Most, in fact, said they are bracing for a recession in 2024.

Meanwhile, 38 percent of CFOs and 39 percent of CHROs feel the same. While those proportions are higher than those of CEOs and board members, it’s important to note that for both groups, they are well below their previous levels. Since July, the proportion of CFOs and CHROs expecting conditions to improve has fallen by 9 percent, each.

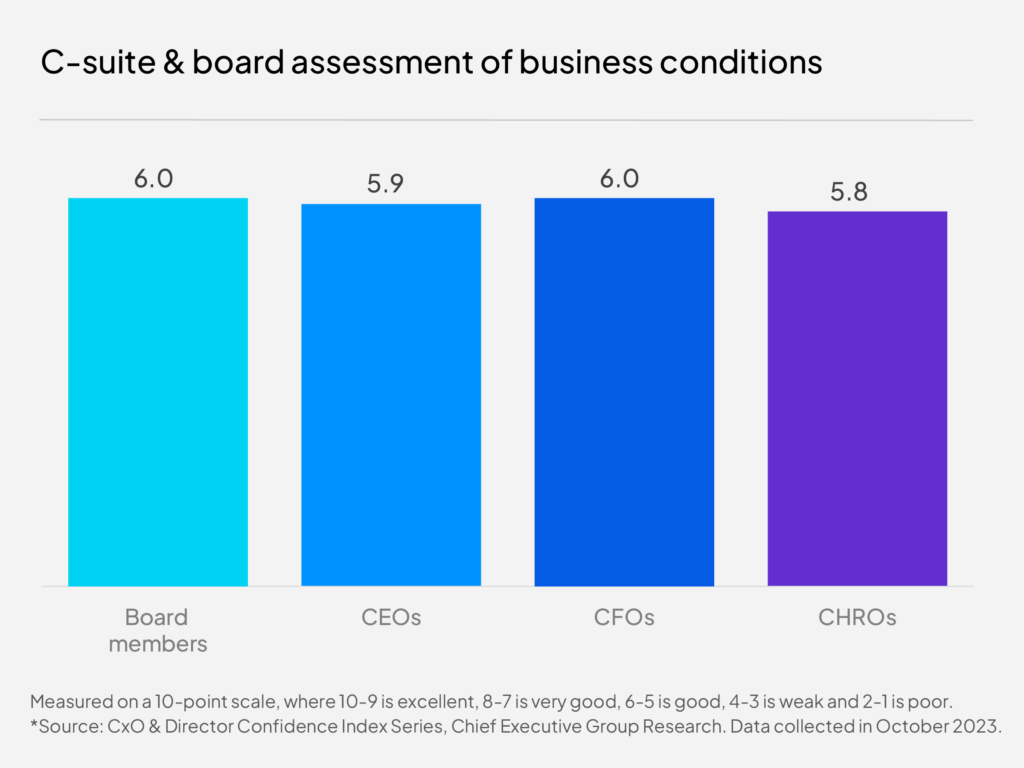

More specifically, when asked to rate current business conditions, on our 10-point scale, and what they expect the business environment to look like 12 months from now, the numbers matched up. From 5.8 to 6.1, all senior executives polled were aligned on what they’re seeing today and what they expect will transpire next year.

About the author

Lead Research Specialist

Kira Ciccarelli is the Lead Research Specialist of the Diligent Institute, the modern governance think tank and global research arm of Diligent Corporation. In her role, Kira researches and produces high-level modern governance reports, blog articles and podcasts designed to inform director decision-making and highlight best practices.

Before joining Diligent, Kira worked in a variety of data-driven research roles, including analyzing global aid funds to the UN Sustainable Development Goals (SDGs) and compiling a meta-analysis of political experimental findings for the Analyst Institute. She holds a BA in Public Policy from the College of William & Mary.

Related content

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – July 2023

Diligent Institute and Corporate Board Member’s Director Confidence Index for July…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – June 2023

Our June poll of public company board members finds a healthy business environment in the…

[rt_reading_time postfix=”minute read” postfix_singular=”minute read”]

Director Confidence Index

Director Confidence Index – May 2023

After a sharp decline in March, the Director Confidence Index clawed back nearly all of…